The Basic Principles Of Custom Private Equity Asset Managers

Wiki Article

The Basic Principles Of Custom Private Equity Asset Managers

In Europe - an even more fragmented market - the connection in between acquistion funds and public equity is far lower in the same amount of time, in some cases unfavorable. Considering that exclusive equity funds have much a lot more control in the companies that they purchase, they can make a lot more energetic decisions to respond to market cycles, whether approaching a boom duration or an economic crisis.

In the sub-section 'Just how personal equity affects portfolio returns' above, we saw exactly how including private equity in a sample profile boosted the overall return while likewise boosting the general risk. That stated, if we check out the exact same sort of instance put in different ways, we can see that including private equity increases the return overmuch to enhancing the risk.

The conventional 60/40 profile of equity and set earnings assets had a danger level of 9. 4%, over a return of 8.

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

By consisting of an appropriation to private equity, the example portfolio danger enhanced to 11. 1% - yet the return likewise enhanced to the exact same number. This is simply an instance based on a theoretical portfolio, however it demonstrates how it is feasible to make use of private equity allocation to branch out a profile and permit for higher modulation of threat and return.

Moonfare does not offer investment advice. You ought to not take any kind of info or other product given as lawful, tax, investment, monetary, or other suggestions.

A web link to this documents will certainly be sent out to the complying with e-mail address: If you would certainly like to send this to a various email address, Please click below Click on the web link once again. Private Investment Opportunities.

The Of Custom Private Equity Asset Managers

Eventually, the owners squander, retiring someplace cozy. Supervisors are hired. https://businesslistingplus.com/profile/cpequityamtx/. Investors are no more running business. This indicates that there is an unpreventable wedge in between the interests of supervisors and ownerswhat financial experts call agency prices. Representatives (in this situation, managers) might choose that benefit themselves, and not their principals (in this situation, proprietors).

The company makes it through, but it comes to be bloated and sclerotic. The sources it is usinglabor, resources and physical stuffcould be utilized much better someplace else, yet they are stuck due to the fact that of inertia and some recurring goodwill.

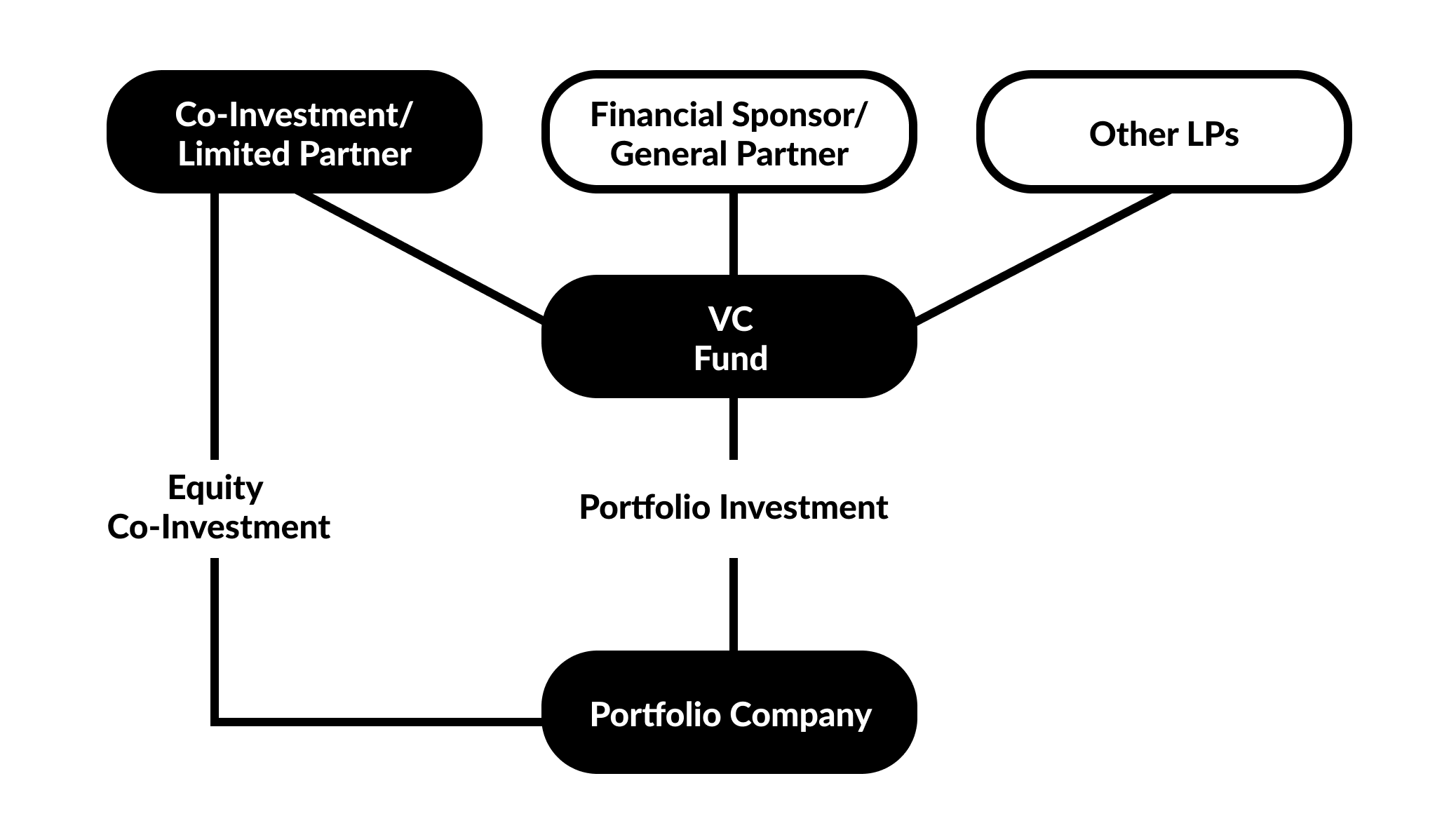

pop over hereIn the normal private equity financial investment, a financial investment fund makes use of money raised from well-off people, pension plan funds and endowments of colleges and charities to buy the firm. The fund obtains cash from a bank, utilizing the properties of the company as security. It takes over the equity from the distributed investors, returning the firm to the place where it was when it was foundedmanagers as owners, rather than agents.

The Best Guide To Custom Private Equity Asset Managers

The private equity fund mounts monitoring with several times that stake. CEOs of private equity-funded firms regularly get 5 percent of the business, with the management group owning as a lot as 15 percent.

In this method, the value of exclusive equity is an iceberg. Minority business that are taken exclusive every year, and the excess returns they make, are the bit above the water: large and crucial, yet barely the entire story. The giant mass below the surface area is the companies that have far better administration since of the risk of being taken over (and the monitoring ousted and replaced by private equity executives).

Firms aresometimes most reliable when they are exclusive, and occasionally when they are public. All companies begin out personal, and many expand to the factor where offering shares to the public makes sense, as it permits them to reduce their cost of capital.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

The doors of resources should swing both methods. Private equity funds give a very useful service by finishing markets and letting companies optimize their value in all states of the world. Takeovers don't always work. While personal equity-backed companies outmatch their private market competitors and, researches show, perform much better on employee safety and other non-monetary measurements, in some cases they take on as well much financial obligation and die.

Villains in organization motion pictures are often investment kinds, in contrast to builders of things. Before he was retrieved by the woman of the street with the heart of gold, Richard Gere's personality in Pretty Lady was an exclusive equity individual. Then he made a decision to construct watercrafts, rather than purchasing and separating business.

American culture commits considerable sources to the personal equity market, yet the return is paid back many-fold by increasing the performance of every business. We all advantage from that.

The 7-Second Trick For Custom Private Equity Asset Managers

Newsweek is dedicated to difficult standard wisdom and searching for connections in the look for usual ground. Syndicated Private Equity Opportunities.

"Furthermore, we additionally found damaging effects on various other actions of patient well-being. For example, scores on wheelchair, abscess, and pain. We locate a coherent, consistent image of patients doing worse after the retirement home is gotten by private equity. We additionally see proof that the nursing home investing goes up for Medicare by about 6-8%." Werner directed out that studies of retirement home during the COVID-19 pandemic located that private equity-managed establishments got on much better than taking care of homes that weren't involved in personal equity at the time.

Report this wiki page